Commission on Poverty Hosts Successful Meeting on Financial Literacy with Auditor General Timothy DeFoor

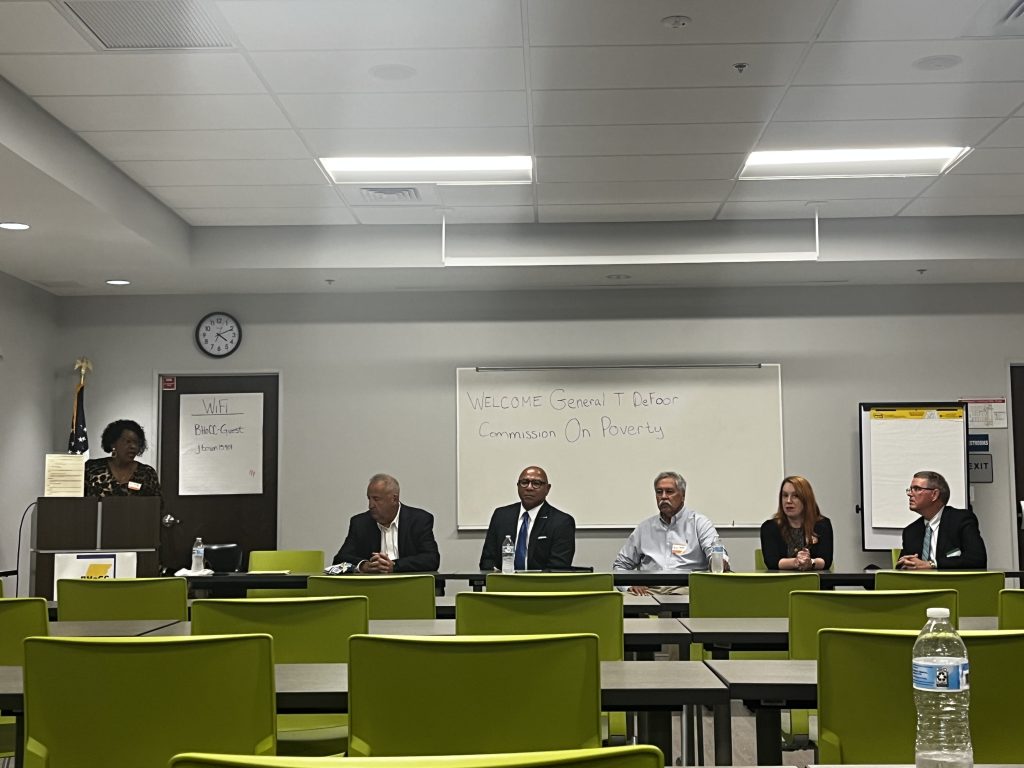

On August 20, 2024, the Commission on Poverty held a significant meeting at the Cambria County Academic Center, located at 110 Franklin Street (Central Park). Pennsylvania’s Auditor General Timothy DeFoor joined community members and stakeholders to discuss the crucial role of financial literacy in combating poverty.

The meeting underscored the Commission on Poverty’s commitment to addressing the needs of economically vulnerable individuals and working towards the eradication of poverty in all its forms. The focus on financial literacy highlighted its importance as a key component in alleviating economic hardship.

Auditor General DeFoor, a strong advocate for financial education, spoke passionately about the barriers created by a lack of financial knowledge. He emphasized that inadequate financial education can leave individuals economically vulnerable and hinder their ability to fully participate in the financial system. His advocacy extends to financial literacy education for adults, educators, and students, underscoring the need for early and comprehensive financial education.

DeFoor noted that equipping young people with money management skills can help break the cycle of poverty and promote financial inclusion. By addressing financial literacy early on, individuals are better prepared to navigate financial challenges and improve their economic stability.

The meeting also provided a valuable platform for public engagement, as DeFoor took questions from attendees, offering insights and practical advice on financial literacy. The discussion reflected the Commission on Poverty’s dedication to implementing practical solutions and collaborating with state leaders to address economic challenges effectively.

Overall, the event was a success, reinforcing the importance of financial education in improving the lives of individuals and families facing economic difficulties. The Commission on Poverty will continue to work towards empowering the community with the knowledge and tools needed to achieve financial stability and inclusion.